Activate to learn more about Slide 1 content.

Activate to learn more about Slide 1 content.

Activate to learn more about Slide 2 content.

Activate to learn more about Slide 2 content.

Activate to learn more about Slide 3 content.

Activate to learn more about Slide 3 content.

Activate to learn more about Slide 4 content.

Activate to learn more about Slide 4 content.

Activate to learn more about Slide 5 content.

Activate to learn more about Slide 5 content.

Medical Debt Relief Program

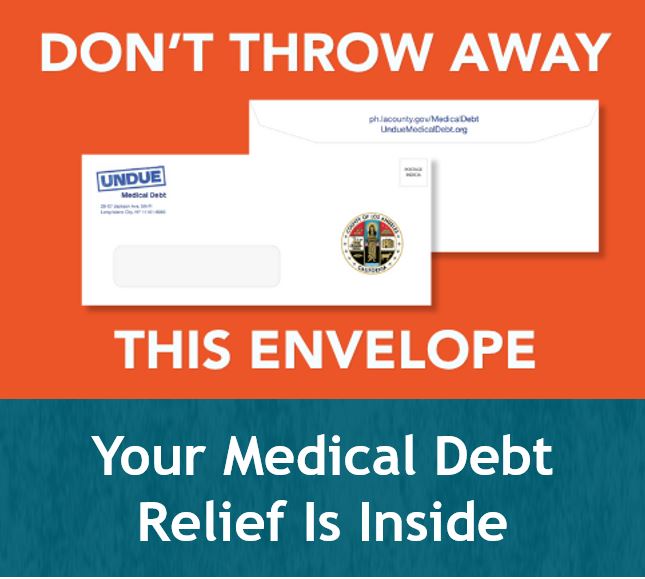

BEWARE OF SCAMMERS: If your medical debt has been relieved, you will receive a letter in the mail from Undue Medical Debt/County of Los Angeles. If you receive a text, phone call or email, it is a scam. We will never ask you to provide information or payment in exchange for medical debt relief.

In June 2024, the Los Angeles County Supervisors committed $5 million in County funds to purchase medical debt for pennies on the dollar. With this investment and additional funds from LA Care Health Plan and the LA County Medical Association, the program can retire more than half a billion dollars in medical debt and make a meaningful difference in the lives of hundreds of thousands of low-income LA County residents.

Public Health partnered with the non-profit organization Undue Medical Debt to implement the program. Residents started to receive letters to say their debt was canceled in May 2025 and, as of December 2025, over $363 million of medical debt has been erased for over 171,000 residents.

This program is part of a larger strategy to address medical debt which includes legislative advocacy, data collection, improved financial assistance programs, and expanded consumer resources. To learn more, see Why is LA County funding this program? below.

FAQs - For the Public

Can I apply for this program?

No. There is no application process for this program and unfortunately, we cannot take requests for help. If you have a bill that qualifies, Undue Medical Debt will pay-off your debt, and you will receive a letter from Undue Medical Debt/County of Los Angeles to tell you that your debt(s) has been canceled.

Who qualifies for medical debt relief under this program?

Eligibility for the program is determined by several factors including income, family size, and whether the provider (hospital, physician group, or collection agency, for example) has chosen to participate in the program.

To qualify for this program, you must:

- Be a current resident of Los Angeles County, AND

- Earn less than or equal to 400% of the federal poverty level (FPL)* - OR - have medical bills that are 5% or more of your annual household income, AND

- Have eligible debt - this means that you must have a bill from a provider (like a hospital or clinic) that is participating in the debt relief program, the bill is past due, and you are not using a payment plan to pay the bill.

*In 2026, for a family of four, 400% of the FPL is $132,000.

How will I know if my debt is erased?

If your debt is erased, you will get a letter in the mail from Undue Medical Debt/County of Los Angeles. The letter will explain which debt(s) has been canceled.

If you lose your letter, please contact Undue Medical Debt to ask for a replacement. You will need to provide information like your name, address, and/or date of birth to confirm you are a recipient.

You may have other medical debt that has not been paid off by this program. If you need help with those bills or need to find no cost (free) or lower cost healthcare, please visit our medical debt resources webpage ph.lacounty.gov/MedicalDebt. You are entitled to financial assistance and there are laws to protect you from unfair billing.

What can I do if I don't get a letter?

If you need help with medical bills or need to find no cost (free) or lower cost healthcare, please visit our medical debt resources webpage.

If your income is 400% of the federal poverty level or less, you are entitled to financial assistance. There are laws to protect everyone from unfair billing.

If my debt is erased, do I owe taxes on it?

No. This debt relief does not count as earned income, so you don't have to pay taxes on it. This is because it was a charitable act from a “detached and disinterested” third party. Undue will not file a Form 1099-C with the IRS.

If my medical debt is relieved, are there strings attached?

No. The debt is being relieved as a gift to you with no strings attached.

The only thing we ask is for you to help by sharing your story or filling out a survey. Your voice is powerful and your story can bring attention to the medical debt crisis and may even inspire others to support medical debt relief. Filling out our survey will help us see how the program is helping people. You don’t have to give your name, and what you share will stay private unless you say we can share it. If you want to share your story or fill out the survey, please follow the steps in the letter you receive when your debt is erased.

How did Undue Medical Debt get my information?

- Your privacy is protected.

- A soft inquiry into your credit history was made to determine your eligibility for medical debt relief by Undue. Soft inquiries are listed on your credit report but do not impact your credit score.

- No personal or medical information is shared with the County of Los Angeles.

- Medical records remain private with the physician or hospital.

- Participating hospitals, physicians' groups and other entities that own medical debt share data with Undue Medical Debt so they can identify who qualifies for debt relief. This includes demographic information like age, income level and address along with insurance status and payer, (insurance company) dates of service, balances still owed, and other information to confirm eligibility. Data sharing complies with HIPAA and information is securely stored. Undue does not receive medical details like diagnosis codes or treatment.

FAQs – About the Program

How does the medical debt relief program work?

- The Los Angeles County Department of Public Health has partnered with Undue Medical Debt, a national, independent 501(c)(3) charitable organization (see What is Undue Medical Debt?).

- Hospitals and other providers in LA County have been invited to participate in the program.

- Providers that opt into the debt relief program send large, bundled portfolios of medical debt account data to Undue Medical Debt for analysis. Undue reviews the data to identify individuals who qualify for relief based on financial hardship and other criteria (see Who qualifies for medical debt relief under this program?). A significant percentage of accounts typically meet these qualifications. Hospitals can then choose to donate or sell the accounts to Undue. Undue then buys the qualified medical debt for pennies on the dollar of the debt’s face value.

- The last step is that Undue Medical Debt, in partnership with the County, sends letters to notify individuals that their qualifying debt has been forgiven.

Note that in this pilot program, Undue can only cancel qualifying medical debts from participating hospitals and other providers located in Los Angeles County. The program will focus on patient accounts where the billing and collections process is complete, and the date of service was generally 18 months to 7+ years ago. Although collections activities may have stopped on these accounts, the medical debts remain outstanding and continue to have negative economic and health impacts on LA County residents. IMPORTANT - the program cannot relieve debt by individual request.

Undue is providing LA County with regular reports on the program’s progress and success throughout its duration.

Why is LA County funding this program?

Medical debt is an important issue in Los Angeles County, affecting one in nine adults. Angelenos across the county have bills they can’t pay for many reasons. They might have welcomed a new baby, found a worrying lump, had an accident, been rushed to an emergency room after a heart attack, or been prescribed expensive medication.

Medical debt is the leading cause of bankruptcy in the United States, and in 2023, residents of Los Angeles accumulated over $2.9 billion in medical debt. Medical debt disproportionately affects families with children, lower-income people, Latino, Black, American Indian, and Pacific Islander residents, and those with chronic health issues. This burden can lead to physical and mental health problems, and financial instability. People may struggle to pay for basics like food and housing and they might skip or delay medical care. Even with insurance, costs can add up quickly and lead to significant debt which can have lasting effects, like lower credit scores, wage garnishment, and property liens. Even if debt is old and collections activities may have stopped - the medical debts remain outstanding and continue to have negative economic and health impacts on residents.

The Los Angeles County Supervisors have committed $5 million in County funds to purchase medical debt for pennies on the dollar. With this investment and additional funds from LA Care Health Plan and the LA County Medical Association, the program can reture more than half a billion dollars in medical debt and make a meaningful difference in the lives of the many LA county residents who are burdened by medical debt today. The program was designed by the Department of Public Health and the Medical Debt Coalition under the leadership of the LA County Board of Supervisors and partners with the national nonprofit Undue Medical Debt. Our overall goal is to eliminate up to $2 billion of medical debt by seeking additional contributions from philanthropic partners, hospitals, and health plans.

What is Undue Medical Debt?

Undue Medical Debt is a national, independent 501(c)(3) charitable organization that was founded in 2014 by former debt collection executives. It was previously known as RIP Medical Debt and Medical Debt Resolution, Inc. Since 2014, Undue has eliminated over $15 billion in medical debt for more than 9.85 million people in the U.S.

What is the role of hospitals in the Medical Debt Relief Initiative?

Hospitals that choose to participate in the debt relief program send data to Undue Medical Debt for analysis and then sell or donate the accounts that meet Undue’s criteria for debt relief (see How does the medical debt relief program work?).

Participating hospitals enter into several agreements with Undue Medical Debt to protect the confidentiality of patient information and other aspects of the transactions.

The Agreements that hospitals and Undue enter into include:

- Business Associates Agreement

- Non-Disclosure Agreement

- Purchase or Donation Agreement (which specifies transaction terms and responsibilities for removing any adverse credit information that applies to the accounts)

For more details on the shared data files, see How did Undue Medical Debt get my information?