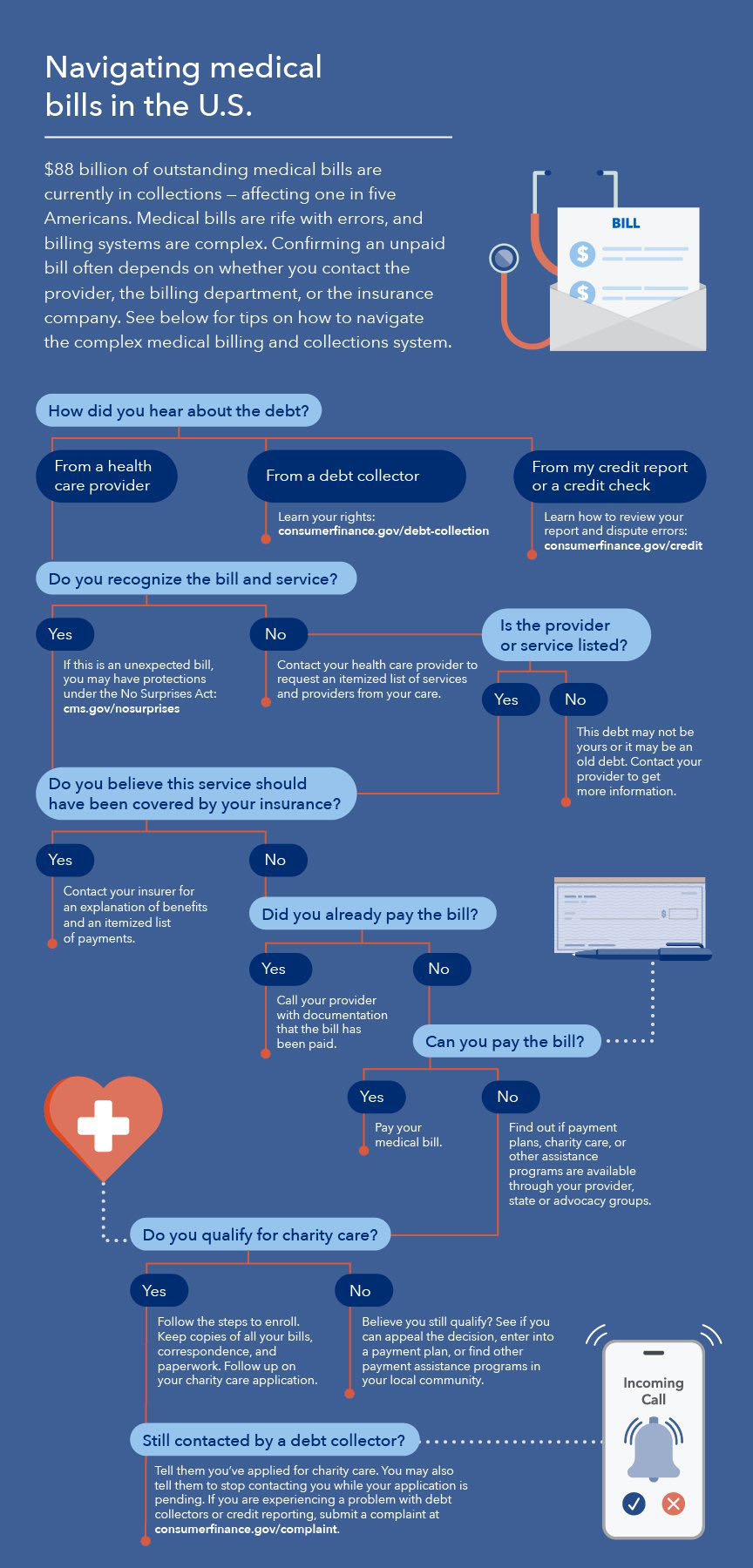

Legal Aid organizations provide free legal services related to medical debt to vulnerable and low-income individuals and families. They represent clients, as well as help with insurance denials, appeals, and negotiating medical bills. Services are delivered in multiple languages, including Arabic, Armenian, Bangla, Simplified and Traditional Chinese, Dari, English, Farsi, Filipino, Japanese, Khmer, Korean, Russian, Spanish, Thai, and Vietnamese.

Neighborhood Legal Services of Los Angeles County (NLSA) provides free legal services and healthcare referrals. NLSA’s

Health Consumer Center represents clients with medical debt and helps with questions about healthcare programs such as Medi-Cal, Medicare, Covered California, County health programs, and in-home supportive services.

Hotline: (800) 896-3202

nlsla.org/services/healthcare

Health Consumer Alliance is a partnership of nonprofit legal services organizations across California that offer free assistance to consumers in understanding and navigating health insurance and medical debt.

Hotline: (888) 804-3536

healthconsumer.org